Core IPs continue to drive outperformance

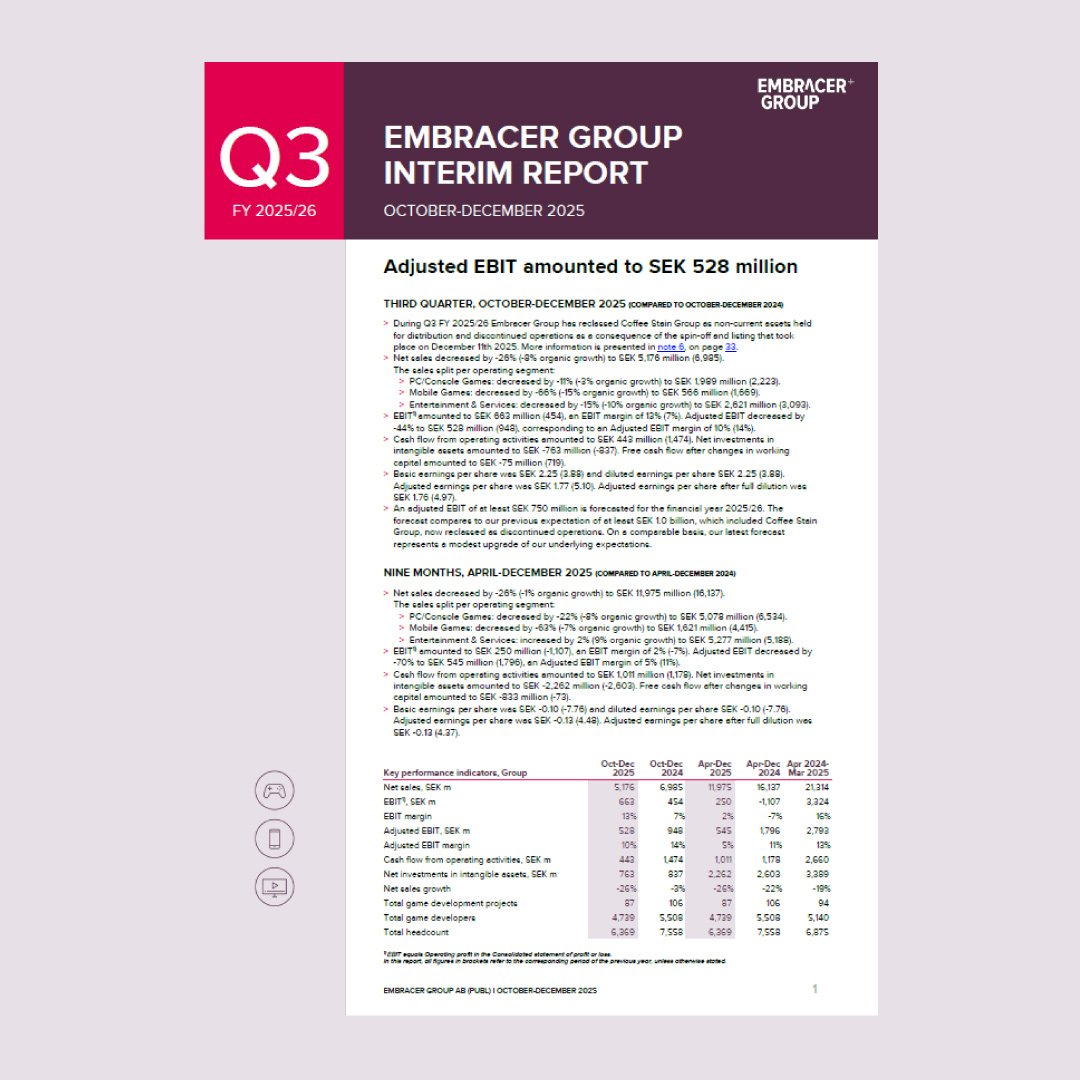

The profitability in the quarter is a clear improvement compared to Q1 and Q2. Organic growth amounted to -8% excluding FX effects, primarily reflecting strong comparables in Entertainment & Services in the prior year.

Our performance in the quarter was driven by strong execution across core IPs including Kingdom Come: Deliverance, Dead Island and Tomb Raider driving higher engagement and earnings than our expectations in the third quarter. Kingdom Come: Deliverance II delivered a standout quarter as the release of the third expansion Mysteria Ecclesiae, combined with marketing, influencers and seasonal promotions converted high demand into strong sales. Kingdom Come: Deliverance II earned PC Gamer’s Game of the Year and four nominations at The Game Awards. The game is also among the nominees for Foreign Game of the Year at the Swedish Game Awards 2026, the first event of its kind in Sweden. Furthermore, we are happy to announce that Kingdom Come: Deliverance II has surpassed 5 million sold copies within its first year of release.

Free cash flow exceeded internal expectations, although it was slightly negative in the quarter, due to working capital effects in our physical businesses. We expect this to normalize in the fourth quarter. We experienced headwinds from a strengthening SEK during the quarter, with the earnings impact partly offset by our natural cost hedge across Europe and North America.

Higher underlying FY 2025/26 forecast

We now expect adjusted EBIT of at least SEK 750 million for FY 2025/26. The forecast compares to our previous expectation of at least SEK 1.0 billion, which included Coffee Stain Group for the full FY 2025/26. On a comparable basis, excluding Coffee Stain Group, our latest forecast represents a modest upgrade to our underlying expectations. The release date of Gothic 1 Remake is moved to June 5th, giving time for final polishing. We continue to see upside potential to our forecast from the underlying business performance.

REANIMAL, developed by Tarsier Studios in Malmö and releasing tomorrow, is our key game release in the fourth quarter. We are excited about the launch, which builds on a successful demo of the game and showcases Tarsier’s creative strengths. Early indications from press are positive and we can’t wait to get the game into players’ hands. Looking towards the end of the quarter, we are also excited about the potential of Milestone’s release of Screamer.

Strong execution on strategic priorities

On 11 December 2025, the spin-off of Coffee Stain Group was completed. With a powerful combination of strong IPs, engaged communities, and innovative talent, we remain confident that the separation will create shareholder value. It allows both ourselves and Coffee Stain Group to better concentrate on core strategies and growth opportunities.

Our focus remains on executing against a well-defined pipeline of major game releases over the next three years. For the next financial year, we look forward to one long-awaited, major, in-house developed and in-house published title together with a range of important mid-sized titles. Execution discipline will be critical to converting this stronger pipeline into a clear profitability and cash generation inflection point in FY 2026/27.

To further improve profitability and cash flow generation, we continue to execute on three strategic priorities: IP-led focus, operational discipline and targeted cost initiatives. During the quarter, we divested several non-strategic and unprofitable businesses in third-party publishing and work-for-hire, improving focus and capital efficiency. These assets jointly had a negative Adjusted EBIT of around SEK -178 million on a trailing twelve month basis. The divestments also free up resources to deploy in higher-return areas, or to return to shareholders.

We are continuously targeting a reduction in both opex and capex through next financial year, as we reduce exposure to non-core IP and as we complete consolidation initiatives. Simplifying and adapting our organization’s size and shape around a more focused portfolio will be key to making better decisions quicker, and to improving profitability.

As discussed at our Annual General Meeting in September, we see significant and accelerating potential in AI-driven tools to meaningfully enhance development, production, and operations. The pace of technological advancement is extraordinary, and as an industry that has always embraced innovation, we actively explore and adopt AI where it strengthens our products and improves efficiency. We view AI as a tool to support and empower our teams. World-building, storytelling, and creative direction will remain firmly human-led, ensuring that creativity and originality continue to define our experiences.

Long-term direction is taking shape

Our long-term direction is taking shape as we build towards a disciplined, IP-first group. We remain committed to continuing the distribution of any excess cash to our shareholders, and we will provide further updates on our strategy and structure as we make progress and as soon as we have more to share.

To conclude, this quarter demonstrates the progress that we are making. By focusing on our core IPs, we can both delight our fans and improve our financial performance. Our focus now is consistent delivery and we thank you for your continued support.

Phil Rogers

Group CEO

Home

Home

Core IP performance drives results exceeding management expectations

In the third quarter, we delivered net sales of SEK 5.2 billion, with adjusted EBIT of SEK 528 million and EBITDAC of SEK 410 million, representing a clear improvement compared to Q1 and Q2 and ahead of our expectations. This was supported by a strong holiday season across core IPs including Kingdom Come: Deliverance. Following the completed spin-off of Coffee Stain Group, we are fully focused on strengthening our core IP portfolio, improving capital allocation discipline, and driving sustainable free cash flow generation. Our strategic direction is taking shape: to become a truly IP-first group centered around our best talents, studios and franchises.