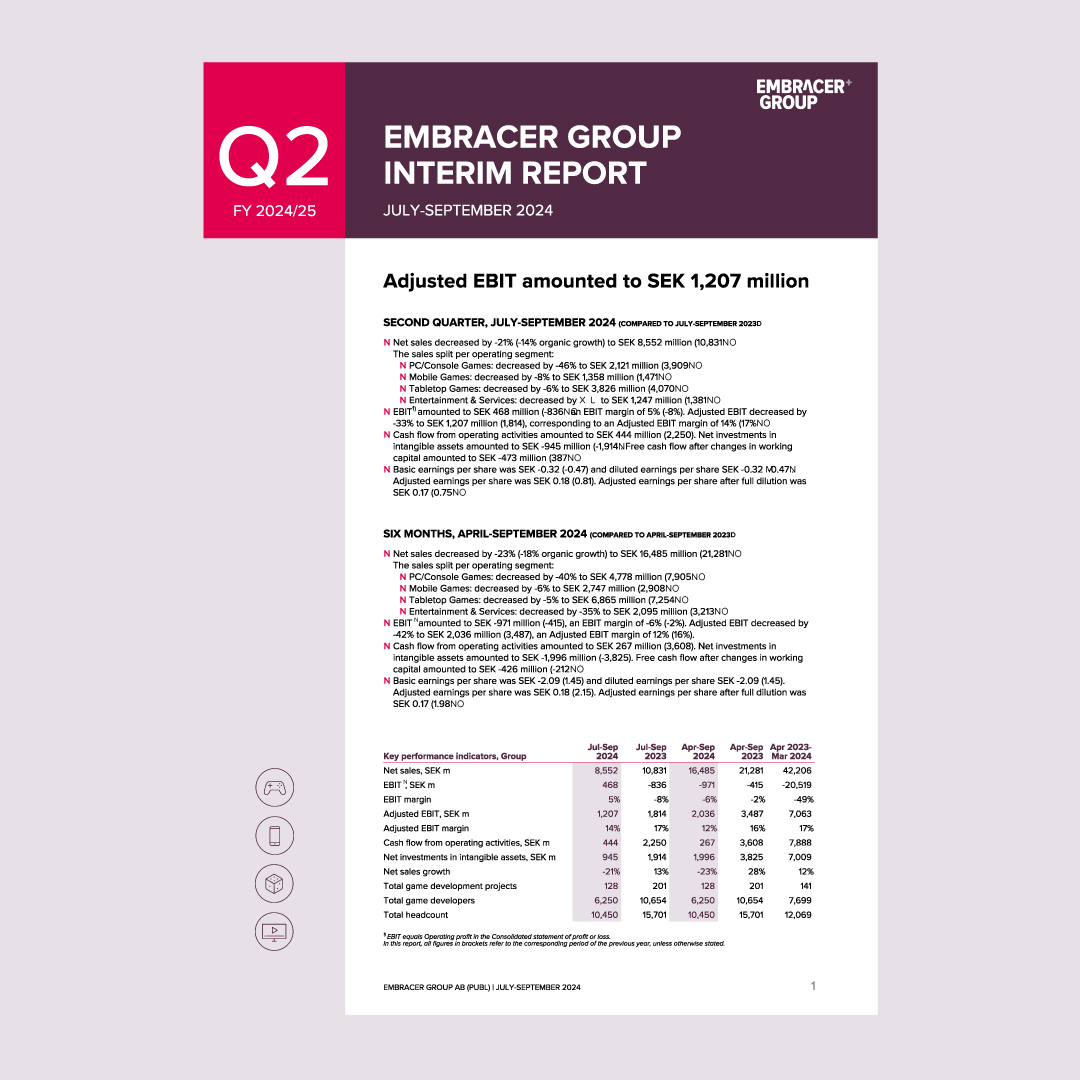

In the quarter, Embracer’s net sales decreased by -21% YoY to SEK 8.6 billion. Organic growth amounted to -14%, primarily due to few new releases and a mixed reception for releases within PC/Console Games. Adjusted EBIT amounted to SEK 1.2 billion, and free cash flow was negative at SEK -0.5 billion, due to the expected seasonal increase in working capital for our physical businesses, including both Tabletop Games (Asmodee) and Entertainment & Services. On a trailing 12-month basis, group free cash flow amounted to SEK 1.2 billion. Cash flow was impacted by the already anticipated return to a normalized working capital cycle in Asmodee, where last year benefited from the unwinding of historic inventory balances. We expect a stronger free cash flow in H2, in line with seasonal trends.

Easybrain divestment will enable the new entities to be separated with strong balance sheets

The divestment of Easybrain is a transformational deal with strong financial and strategic rationale, completely resetting our balance sheet. Easybrain has created tremendous value since 2021 for shareholders. Post- divestment, as of Q2 and on a pro forma basis, our total net debt is around SEK 0.5 billion, and, excluding the debt ringfenced to Asmodee, our net cash position is at around SEK 8.9 billion. Our interest rate costs, which impacted free cash flow by around SEK 1.3 billion in FY 2023/24, will significantly decrease going forward.

The expected cash inflow of SEK 12.7 billion puts us in a much stronger position to drive value, both in the short- and in the long-term. We will become a better and more resourceful owner of our remaining companies, enabling them to make better business and decisions on an ongoing basis. The transaction will also allow for our future stand-alone entities to be separated with strong balance sheets. This will include a capital increase into the ringfenced Asmodee Group, reducing its leverage to an optimal level ahead of the spin-off. In addition, we are focusing on the best allocation of companies and assets in our future structure.

Improved performance expected in H2 despite delays

In Q3, we expect solid Adjusted EBIT growth YoY for Tabletop. For Mobile, we expect lower earnings YoY, due to higher UAC-to-sales as well as a softer YoY net sales development. For PC/Console, we expect limited or no Adjusted EBIT, as there are no notable new releases within the period. For Entertainment & Services, we expect notable earnings growth YoY, supported by the theatrical release of The Lord of the Rings: The War of the Rohirrim.

For FY 2024/25 we now expect lower earnings YoY due to the confirmed or likely delay of a number of notable releases in H2 within PC/Console, as well as lowered expectations for games released in H1. Kingdom Come: Deliverance II remains set to be released on February 11, 2025.

The book value of completed games development within PC/Console is now expected to reach around SEK 3.1 billion (SEK 3.9 billion as of Q1) in FY 2024/25, of which SEK 0.9 billion is expected to either be released very late in Q4 or shift to the next financial year. To create the most long-term shareholder value from our invested capital, we remain focused on releasing high-quality and polished products with optimal release windows. This approach ensures that we also maximize the opportunity to meet the high expectations and quality demand of gamers and fans around the globe.

Apart from Kingdom Come: Deliverance II, we have announced several other important titles, that will now either be released in H2 FY 2024/25 or in FY 2025/26. These include Deep Rock Galactic: Rogue Core, Fellowship, Gothic 1 Remake, Hyper Light Breaker, Killing Floor 3, REANIMAL, Satisfactory (console), Titan Quest II, Tomb Raider IV-VI Remastered, and Wreckfest 2, among many others.

Lower activity in Q2 as expected, with strong execution from Asmodee

In the PC/Console Games segment, organic growth amounted to -33%, as expected, due to few new releases and a tough comparison from the releases of Remnant II and Payday 3 last year. The 8% Adjusted EBIT margin was largely in line with expectations but remained impacted by a low ROI for primarily small-and- mid-sized releases in the past two years. The most notable new release, Disney Epic Mickey: Rebrushed, late in the quarter, was well received by players but initial digital sales were slower than expected. After several years in Early Access, the full release of Satisfactory on PC performed above management expectations, with a solid inflow of new players, driving over 200,000 concurrent players in September.

For Asmodee, Adjusted EBIT grew by 5% YoY to around SEK 700 million, with an improved margin supported by a favorable product mix. The organic growth amounted to -4%, in line with management expectations. Growth in games published by Asmodee was offset by a decrease in games published by partners, which performed well in Q2 last year. Asmodee has strong traction for in-house published games, strengthening profitability. Early sell-in to resellers of LEGO® Monkey Palace and The Lord of the Rings: Duel for Middle-earth™ games, both officially released in the first days of Q3, showed strong traction in the quarter. In Q3, Star Wars™: Unlimited will also release its Set 3, Twilight of the Republic.

In the Mobile Games segment, organic growth improved sequentially to -7% YoY, despite relatively low user acquisition spending in previous quarters. Growth is also impacted by CrazyLabs’ previous transition to a product strategy with lower sales but higher margins. Adjusted EBIT was stable YoY but lower than in recent quarters, with a 28% Adjusted EBIT margin. Underlying market trends improved somewhat compared to the most recent quarters, with better conditions to scale up user acquisition costs, drive player activity as well as improved organic revenue growth. We expect these dynamics to also carry into the second half of the year.

The Entertainment & Services segment had another slow quarter, largely as expected, with few new releases. Organic growth amounted to around -9% YoY with 2% Adjusted EBIT margin, with a product mix more geared to our physical businesses within PLAION. Middle-earth Enterprises is looking forward to the theatrical release of the original anime The Lord of the Rings: The War of the Rohirrim, in Q3, on December 13. There is increasing anticipation for the release, with encouraging fan reactions.

Asmodee spin-off around the corner, as we shape our business for the future

The Capital Markets Day for Asmodee in Stockholm next week, on November 19, will be an important milestone in the spin-off process, offering an opportunity to meet both the management team and the board of Asmodee, and gain deeper insights into the company and its market. Following a visit to SPIEL Essen, a consumer board game exhibition, in early October and with a strengthened balance sheet, we are even more confident that Asmodee will be well- positioned to build on its successful track record, unlocking shareholder value.

Over the past 15 months, we have created a stronger foundation for long-term value creation, lowering our net debt and our capex. We have many high-performing and efficient companies, several with industry leading margins. However, we acknowledge that parts of our PC/Console and Entertainment & Services segments are still underperforming due to delays and low ROI for primarily small and mid-sized releases. Combined with fixed operating costs this creates unacceptable margins which we are firmly addressing ahead of the spin-offs.

I would like to send my thanks to all our team members, shareholders, customers, and business partners for contributing to the continued prosperity and success of our new chapter. We have leading intellectual properties, iconic titles, talented teams, studios and great assets, that will make us exceptionally well- positioned for the long-term. In closing, I would like to send a special thanks to Oleg Grushevich and his team at Easybrain for their dedication and contributions throughout the years.

November 14, 2024, Karlstad, Värmland, Sweden

Lars Wingefors

Co-founder & Group CEO

Home

Home

Strong execution by Asmodee, Easybrain divestment transforms balance sheet

In Q2, net sales amounted to SEK 8.6 billion, with Adjusted EBIT of SEK 1.2 billion. Asmodee delivered solid earnings growth YoY, in line with expectations. We confirm that the process to spin-off Asmodee is on track for this financial year. The quarter was softer for our other segments and within PC/Console we now expect lower earnings this year due to the delay of a number of notable H2 releases while we continue our ongoing work to improve efficiency and increase ROI. The divestment of Easybrain, announced today, has a strong strategic and financial rationale, transforming our balance sheet and putting us in a stronger position to create value.