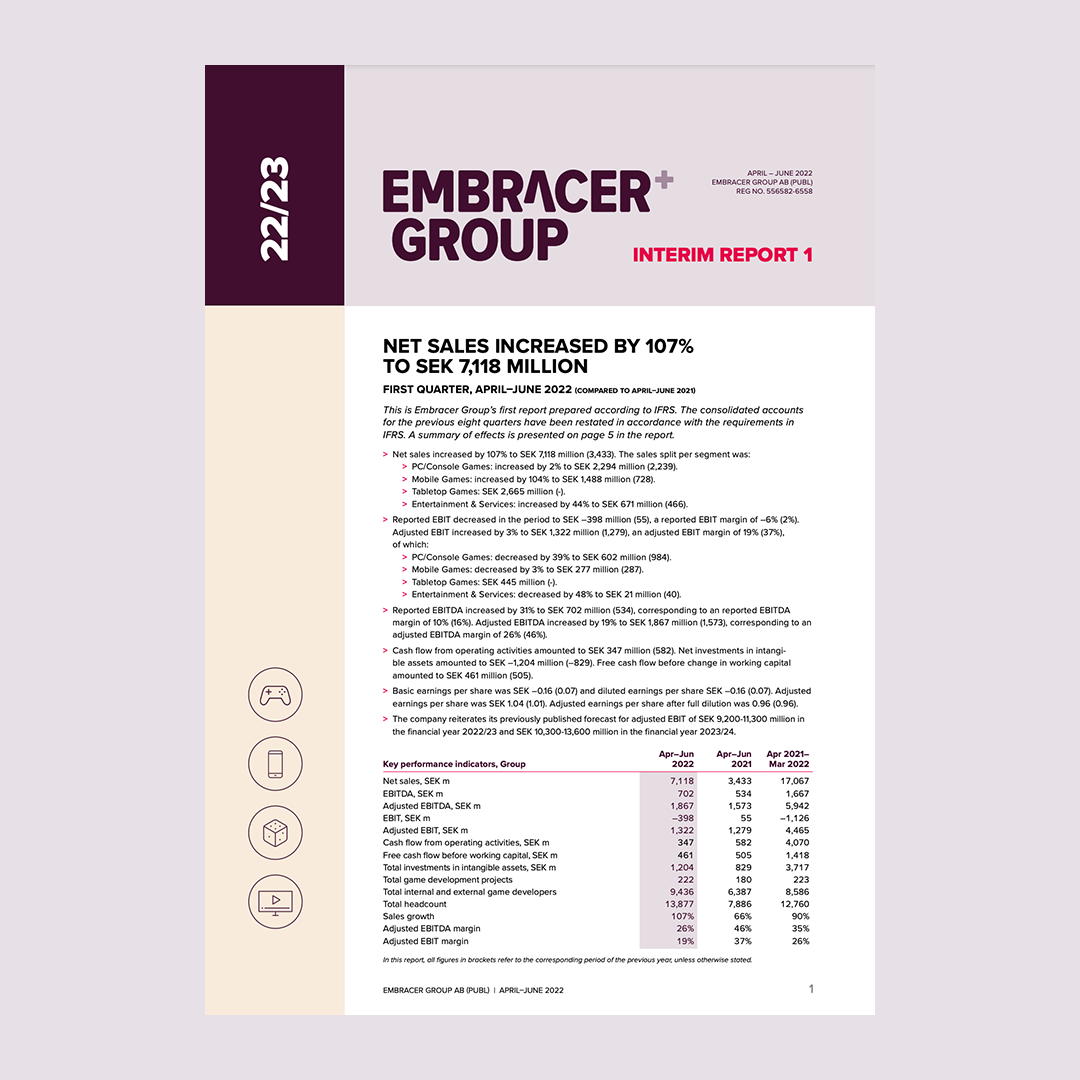

As anticipated, the first quarter was relatively quiet, albeit a record quarter for the Group in financial terms: Net sales were SEK 7,118 million in the quarter and adjusted EBIT (Operational EBIT) was SEK 1,322 million. The operational performance was largely in line with our expectations. The quarter had a relatively low release activity in the segments PC/Console Games and Entertainment & Services and the comparison numbers include last year’s release of Biomutant. PC/Console Games sales were dominated by back catalog titles. The only new release that had a notable financial contribution in the PC/Console Games segment was Evil Dead: The Game.

The Mobile Games segment continues to perform strongly with 20 percent organic growth (CCY). We continue to see a strong return on ad spend (ROAS) for our mobile games portfolio and consequently we invest more into user acquisition, which somewhat burdens the margin in the quarter.

The Tabletop Games segment, with the operative group Asmodee, had a strong momentum driven by high demand especially for trading-cards, in spite of the period typically being seasonably weaker. The segment reported Net Sales of SEK 2,665 million and adjusted EBIT of SEK 445 million, making it the Group’s largest revenue contributor in the quarter.

We continue to grow organic investments into our games development pipeline with a record of SEK 1,114 million invested into games development that will drive the organic growth of the company for many years to come. On the short term this however contributes to the negative free cash flow in the quarter. We do expect a strong free cash flow for the full year, reducing the leverage of our balance sheet. The increase in net working capital in the first quarter is primarily a consequence of the buildup of inventory within Tabletop Games ahead of the seasonally strong third quarter. This will notably decrease during the second half of the financial year.

We have a very long-term view, both when it comes to organic and inorganic investments. I would like to emphasize that we don’t optimize the company by percentage margins, but by absolute profit numbers and on the long-term adjusted earnings per share.

Reiterating our adjusted EBIT forecast

For the Group as a whole, we reiterate our forecast for adjusted EBIT of SEK 9.2-11.3 billion in the financial year 2022/23 and SEK 10.3-13.6 billion in the financial year 2023/24. We are on track to deliver on our ambitious plan for growth, albeit acknowledging a more challenging market environment.

At the beginning of the year, Newzoo projected the gaming market to grow about five percent in 2022, whereas now they revised it down to two percent. Just as the rest of the market, we have seen some effects from inflation, pressure on consumer spending and advertising, as well as remaining pandemic effects including hardware shortages. However, new releases for PC/Console are expected to be the main organic growth driver in the coming quarters and years.

Looking into the adjusted EBIT breakdown of the year we expect Q2 and Q3 to be clearly stronger than Q1, somewhat in Q3’s favor, driven by both new releases and seasonality. Q2 is supported by the reboot of Saints Row and other notable platform deals. Further, we expect Q4 to be the clearly strongest quarter of the financial year driven by a few strong releases including a long-awaited AAA title, now expected in Q4 and to be announced soon.

Well positioned to outpace market growth as Gamescom nears

Our growth model is unchanged. Our main priority across our business segments is to achieve profitable organic growth. We believe that we are well positioned to continue to outpace the market growth in all our four segments, due to the investments we have made into our pipeline and the growth potential of our existing products and services.

The organic growth for the overall Group was –12 percent in the quarter. For the remainder of the year, we expect to notably outgrow the rest of the market, with an overall organic growth of 20-35 percent for the full financial year for the Group.

We are excited to share more with the world in the months and years ahead about all the things that we are building. With more than 220 ongoing game development projects, our well-invested development pipeline is now maturing. It includes more than 25 AAA games under development to be released until the financial year 2025/26. After an extended period without major releases in PC/Console Games, we are now entering a new phase of higher release activity. We expect to release two AAA games during the remainder of this year, as well as to receive royalties for Gearbox’s AAA game Tiny Tina’s Wonderlands, which was released late in the previous fiscal year. The reboot of Saints Row hitting physical and digital stores on August 23 will be one of the most important releases in this financial year. Excitement for the game among fans is building up. Pre-orders for Saints Row are solid and are tracking in line with our expectations.

The second of the two remaining AAA-releases is another highly anticipated game, to be announced soon and released in the fourth quarter. In addition, AA, A and Indie titles and several exciting mobile titles and many new board games, are slated for release in the coming quarters. In the third quarter, for instance, the much anticipated (or dreaded) sequel Goat Simulator 3 will be released by Coffee Stain. At THQ Nordics 2022 Digital Showcase, last week, several exciting titles were announced, including Alone in the Dark, Outcast 2 and

All Elite Wrestling. Our publishers will announce many new games in the coming period, including multiple full game announcements at Gamescom next week. One of the Group’s AAA projects has transitioned to another studio within the Group. This was done to ensure the quality bar is where we need it to be for the title. We are not expecting any material delays for the title based on this transition.

The third quarter is expected to be supported by seasonally strong demand within Tabletop Games, Mobile Games and Entertainment & Services. The strong pro forma growth in our Mobile Games segment is expected to continue as we keep investing in user acquisition with attractive returns on ad spend. Our Tabletop Games segment (Asmodee) continues to see solid organic growth and market share gains, and is expected to contribute SEK 2.0-2.5 billion to adjusted EBIT in the full financial year 2022/23.

IFRS-conversion an important step

I am very proud and thankful to our finance team and advisors for finalizing the largest IFRS conversion project ever in Sweden – ahead of the original timeline. This is an important milestone in constantly improving corporate governance in our group. The process to change the listing venue to the main market at Nasdaq Stockholm by the end of the calendar year is consequently on track. We have restated our net sales and adjusted EBIT, excluding acquisitions related costs, for the past two financial years and the difference under the IFRS reporting standard is less than one percent.

Strong balance sheet

In the current financial environment, it is importance to retain a strong balance sheet. We remain committed to delivering on our financial leverage target. So far in the history of Embracer Group, we have relied solely on equity and bank financing. We cherish the long-term commitment from our existing shareholders as well as our Nordic relationship banks Nordea, SEB and Swedbank. During the summer, we have extended our group of relationship banks with HSBC and Svensk Exportkredit and look forward to working with them on an equally

long-term horizon.

With our unique eco-system in the gaming and entertainment industry, we are an attractive partner for many of our friends in the industry. During the quarter we welcomed the strategic investor Savvy Gaming Group, who invested SEK 10.3 billion in a directed equity issue. We continue to have conversations with several industrial partners about supporting our long-term strategy either through investments or partnerships.

At the time of publication, we have access to SEK 20 billion in available cash and credit facilities, SEK 6 billion expires in June 2023 and the rest not until 2024 or later.

M&A update – busy but increasingly selective

During the quarter, we were happy to welcome the development studios Crystal Dynamics, Eidos-Montréal and Square Enix Montréal to the Group, together with 1,100 talented employees and an exciting catalog of IPs including Tomb Raider, Deus Ex, Thief, Legacy of Kain, Championship Manager and more than 50 back-catalog games. The transaction is expected to close soon and is an important contribution to our PC/Console Games segment.

We have a strong funnel of M&A opportunities to support our long-term growth ambitions. We see many attractive bolt-on acquisition opportunities across all of our segments. We are eagerly scouting for strong IP’s as well as talent and capabilities that make our eco-system stronger. Price expectations have been revised especially for under-capitalized businesses. We are prudent and increasingly selective in order to ensure that we allocate our shareholders’ investments wisely.

Embracer Group is a unique group in a dynamic industry, empowered by our decentralized operating model. We are proud of the entrepreneurs and companies we have combined with strong market positions across key verticals and an extensive catalog with more than 800 owned and controlled IPs. We have a well-invested pipeline of upcoming premium PC/Console games. We

have a leading position in ad based free-to-play mobile games and a strong track record of bringing new games to market successfully. We are a leading publisher and have an extensive distribution network across 50 countries in tabletop games to support our 22 internal studios and leverage our product portfolio, including the most modern classics within board games.

Today we work with most of the major licensors, supporting the development of transmedia experiences based on some of the most beloved IP’s in the world. Consequently, studios and publishers across our Group are experienced and well positioned to capitalize on the transmedia opportunities in our vast catalog of owned and controlled IP.

Several video game adaptions of Asmodee’s franchises are already in the concept phase. Multiple of Dark Horse’s franchises are being evaluated for development of both video games and tabletop games. Simultaneously, Asmodee and Dark Horse are actively evaluating opportunities of adapting our video games franchises to board games and comic books. We are actively pursuing partnerships with established industry players to bring more of our IP’s to film, TV and streaming.

New sustainability goals

Sustainability continues to be an important priority in our long-term development, and we are continuously developing our efforts within our sustainability framework. In the quarter, the Board of Directors resolved on new, ambitious sustainability goals for the group, providing a clear direction for our sustainability work going forward:

- Double the number of female Managing Directors/Studio Heads by 2025 compared with the base year 2021/22.

- Reduce the carbon emissions by 45% by 2030 compared with the base year 2021/22, in line with the Paris Agreement, and set Science-Based Targets during 2022/23.

- Every operative group to set sustainability goals during 2022/23.

- The inhumane and unjust war in Ukraine and its consequences have meant a new geopolitical and economic landscape that we closely monitor. Our foremost focus is our employees in the regions directly affected by the conflict. All our internal development resources are fully utilized and the relocation efforts continue as previously communicated.

To conclude, I would like to send my thanks to all our shareholders, employees, customers, industry colleagues and business partners for contributing to the prosperity and success of Embracer Group.

August 18, 2022, Karlstad, Värmland, Sweden

Lars Wingefors

Co-founder & Group CEO

Home

Home

20-35% Organic growth excpected FY22/23

We are pleased to announce another stable quarter within the communicated guidance. We are on track to deliver on our ambitious plan for growth and although the market has softened somewhat, we reiterate our forecast for the current and next financial year. Today we reached a major milestone by publishing our first quarterly report under IFRS, reporting by our four business segments: PC/Console Games, Mobile Games, Tabletop Games and Entertainment & Services.