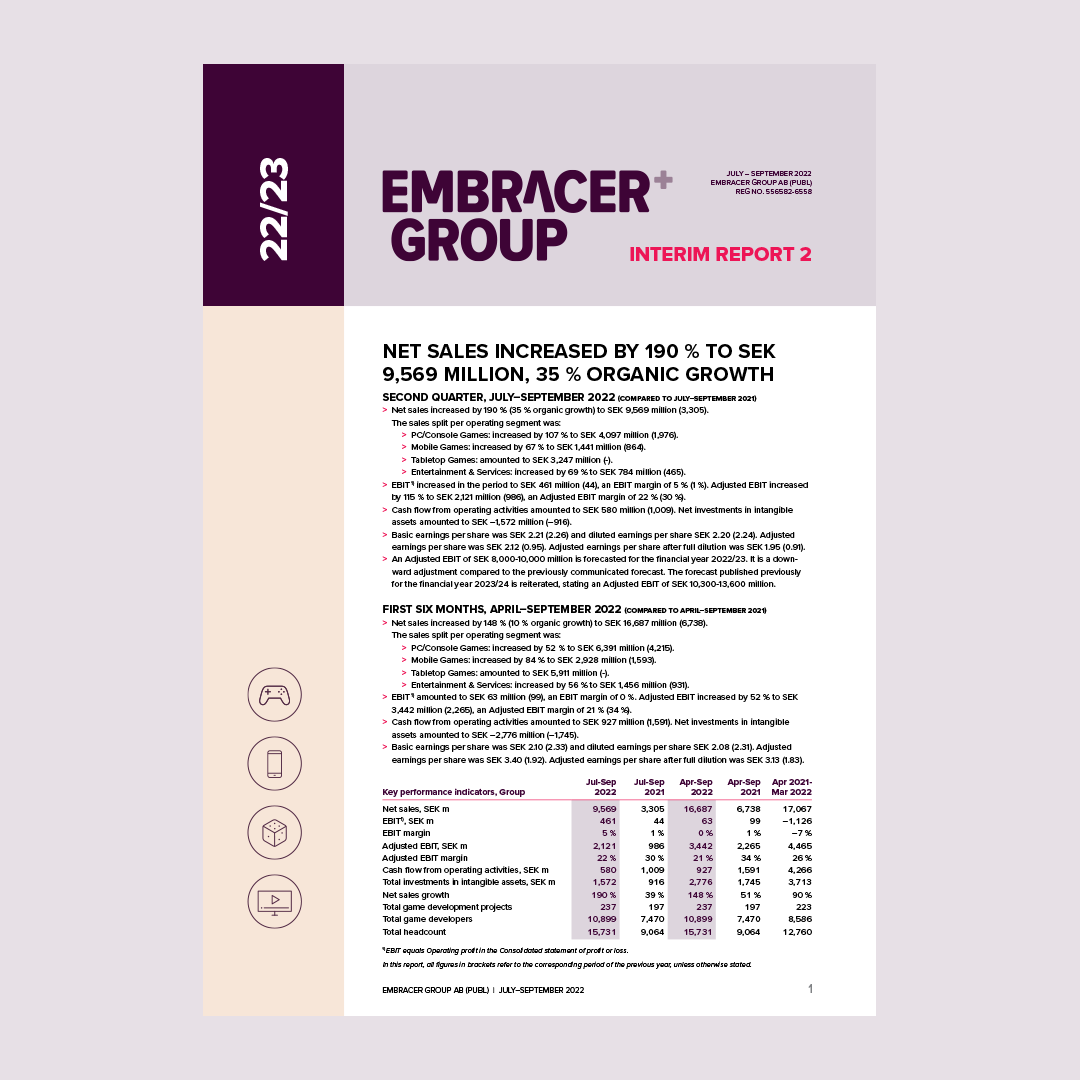

For the overall group, we now expect Adjusted EBIT of SEK 8.0-10.0 billion in FY 2022/23 while we reiterate the forecast SEK 10.3-13.6 billion for FY 2023/24. The reduced forecast for the financial year 2022/23 reflects a mixed reception to some of the key second quarter PC/console releases, estimated to impact catalog sales in the coming quarters, shifts in the PC/console pipeline, including Dead Island 2, now planned for release April 28, and a more cautious view on the current macroeconomic situation, particularly related to the Mobile Games and Tabletop Games segments. The forecast includes a range of outcomes from a partnership- and licensing deal with several industry partners expected to be completed during the financial year 2022/23.

New initiatives to capitalize on our strong position

Over the past several years, we have invested significantly in creating one of the largest providers of PC/Console content in the industry. We have close to 10,000 developers creating games, many based on Embracer’s deep and growing catalog of IPs. Our efforts in this regard have created significant collective value which we are now starting to realize. One result of such efforts to capitalize on the value we have created is a transformative partnership and licensing deal, that we have worked on with several industry partners. This deal covers a range of large-budget upcoming games over the coming six years. We expect the whole or parts of this deal will close during this financial year, thereby, it would improve predictability, lower business risk and provide a positive impact on our cash flow and profits. It would also enable further investments into making even greater games based on both established and new IPs. The impact of the above-mentioned deal will be a factor in our forecasted Adjusted EBIT range for this and next financial year.

The increasingly challenging market environment has proven to be another factor year-to-date. In early November, Newzoo cut its forecasts for the video games market from 2 % growth to a 4 % decline in 2022. The global economy has seen a slowdown and might be moving toward a recession. Games offer good value for money for consumers. Consequently, games are historically less affected by the general fluctuations in consumer purchasing power. Regardless it is fair to assume that all industries, including the games industry, will see some impact from weaker consumer sentiment.

Continuously developing our decentralized operating model

The organic growth during the quarter of 35 % was, as expected, primarily driven by new releases within PC/console, in particular supported by the reboot of Saints Row, which was released on August 23. The reception of Saints Row did not meet the full expectations and left the fanbase partially polarized. The game development studio, Volition, has been working hard to improve the player experience.

Financially, Saints Row has performed in line with management expectations in the quarter. Going forward, Volition will transition to become part of Gearbox which has all the tools, including an experienced management team in the US, to create future success at Volition. This is the first internal group transfer where we transfer a major studio between operative groups, but it is not necessarily the last.

Asmodee continues to deliver a solid performance and has outgrown the tabletop market in both EU and the US this financial year. The performance is, in particular, driven by strong demand for trading cards, which brought certain pressure on the gross margin. Asmodee is currently tying up excess levels of working capital and management actions have been taken to enable a decrease over the coming 12 months in the inventory levels to the historical average. We expect a substantial improvement post the peak-season already by end of this financial year.

The business segment Mobile Games is favorably positioned, with a primarily ad revenue-based model. The ad markets are impacted by the looming recession and likely some lingering effects from the changes to IDFA. We consider our mobile businesses within ads as leading in the industry, and they adapt quickly to new conditions, constantly balancing profit and growth for the best longterm performance.

Turbulent times create new opportunities

We continue our long-term mindset in building enduring, innovative and profitable businesses in a creative industry. I have a firm belief in our decentralized operating model, which is built around experienced and successful creators and entrepreneurs. That said, the world has changed for the worse in many areas, becoming darker in recent months. We need to adapt to the challenges of geopolitical and social issues around the world and the new macroeconomic reality. The increased cost of capital will impact our business going forward. The adjustments in the cost of capital will, compared to before, require current and future investments, both organic and in-organic, to have a higher minimum hurdle with a safety margin to justify the capital allocation. We need to continue our sharp focus on the execution of our ongoing business around the world.

Therefore, the Board of Directors decided on November 16 to launch a special review of our business to navigate the new market conditions and how we both make sure all businesses have all the tools to succeed and maximize long-term shareholder value creation. The outcome of this review may, for example, lead to board recommendations to make spin-off/s (under Lex Asea) into separate publicly listed companies in the future, if that is deemed to be the best for its employees, create higher shareholder value and improve our strategic flexibility.

In the current financial environment, it is important to retain a strong balance sheet. We expect to reach our financial leverage target by the end of this financial year, and we had substantial headroom in relation to financial covenants already at the end of September. During the quarter we made a voluntary debt repayment of SEK 6.2 billion and at the end of the quarter we had access to SEK 10 billion in available cash and credit facilities. There are no material loans that will expire prior to June 2024.

Our ongoing project to change listing venue to Nasdaq Stockholm Main Market is on track to be concluded before the year-end, further strengthening transparency, governance and liquidity in our shares. I would also like to take this opportunity to welcome Cecilia Driving, elected at the annual general meeting, to the board of directors of the parent company and as chair of the Audit and Sustainability Committee. Business ethics and governance is the foundation for our sustainability strategy. During the quarter, we adopted and implemented new Group-wide policies and several important steps to enhance information security throughout the group.

To conclude, I would like to send my thanks to all our shareholders, employees, customers, business partners and industry colleagues for contributing to the prosperity and success of Embracer Group.

November 17, 2022, Karlstad, Värmland, Sweden

Lars Wingefors

Co-founder & Group CEO

Home

Home

Capitalizing on our strong position in a more challenging environment

We are pleased to announce another stable quarter for Embracer. The second quarter is the strongest quarter so far in terms of net sales and Adjusted EBIT for the Group, supported by a solid organic growth of 35 percent. As we are gearing up to meet an increasingly challenging market environment, we are working on a transformative content partnership and have separately also launched a special review of our business to further optimize our decentralized model, capture new opportunities and add strategic flexibility.