Embracer Group is a global group of gaming and entertainment businesses. Its more than 10,000 passionate professionals deliver entertainment to gamers and value to customers around the globe supported by one of the industry’s largest portfolios of intellectual property including some of the most popular and iconic titles in gaming, comics, and other media.

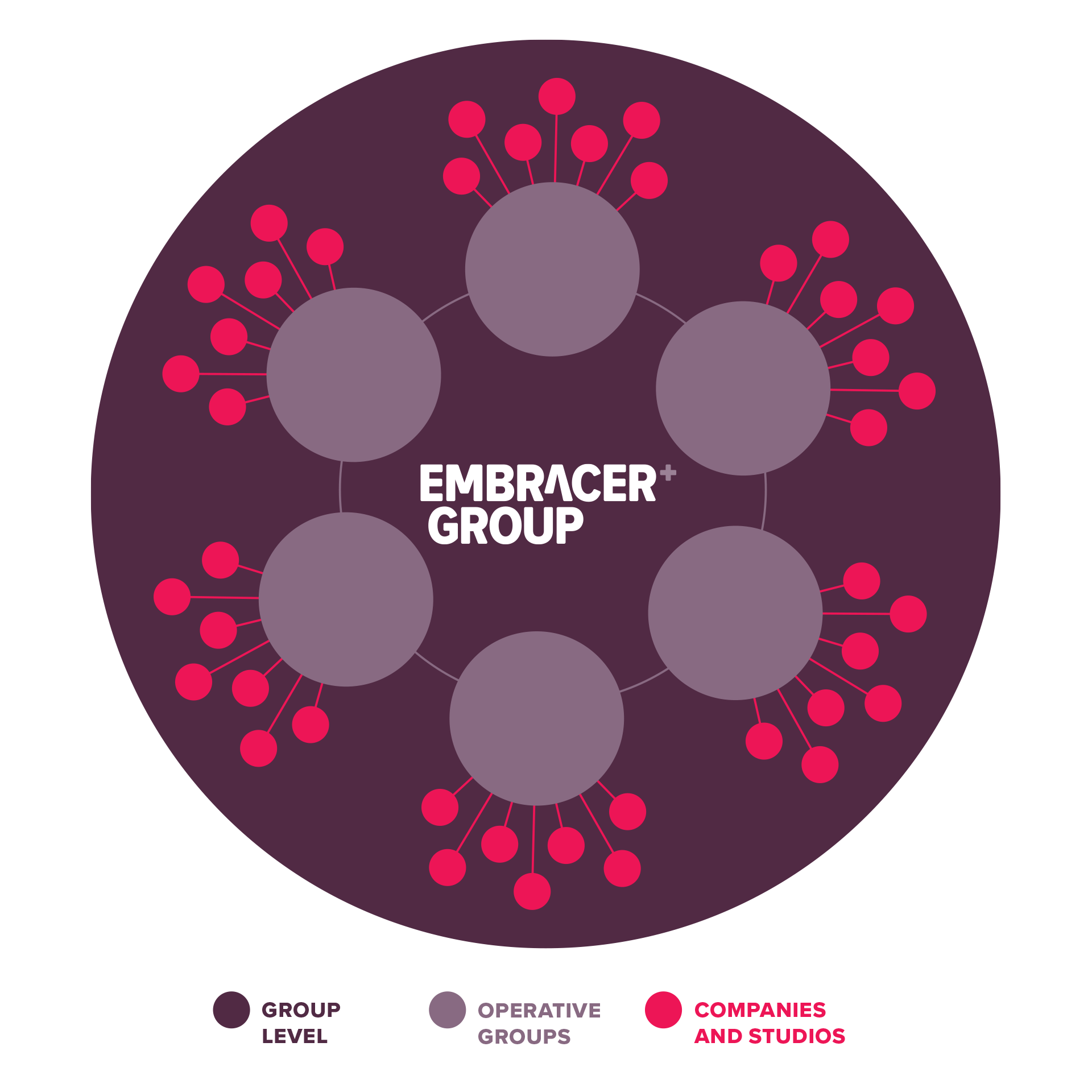

Embracer Group has a decentralized operating model where great entrepreneurs run operations through operative groups – each with their own distinctive heritage, branding, business strategy, and other characteristics – all within a shared framework of governance and accountability.

The Embracer Group head office hosts control and support functions, provides access to capital, shared knowledge, intra-Group synergies, and a solid governance framework. The organization is lean as the operative groups have significant responsibility for managing commercial operations and for implementing the governance framework including financial control, governance, compliance, human resources, and communication.

The operative groups serve as primary ecosystem building blocks. They have financial and operational responsibility and accountability, and run the businesses largely independently from each other, based on Embracer Group’s values and governance model and with active support and coordination from Group-level functions.

Embracer Group adapts a multi-brand strategy where game and entertainment consumers meet Embracer through any of the numerous brands, each with its unique way, style, and spirit.

Embracer Group comprises an ecosystem for studios, publishers, and other gaming and entertainment companies. The collaborations, empowerment, and business opportunities presented to companies are unique.

The Group realizes synergies where possible and deemed appropriate. This includes collaboration, spread of best practices, as well as IP, publishing, distribution and talent sharing. Centrally mandated integration initiatives are also considered in order to foster revenue and cost synergies.

Embracer Group management continuously evaluates the performance and outlook of the companies within the Group. Capital allocation decisions above a certain level, including for example game development projects, must be approved by the parent company. Risks are mitigated through an enhanced greenlight approval process for capital allocation. All studios are required to have a formalized development process for projects including quality assurance, initiation controls, approvals, milestones and project follow-up. An enhanced model with common milestones is in progress.

Embracer Group is organized in four operating segments: PC/Console Games, Mobile Games, Tabletop Games and Entertainment & Services.

Through these operating segments, Embracer Group has strong market positions in PC, console, VR, mobile, and tabletop games, as well as niche positions in film and comic book publishing, including attractive partner publishing. Together these operating segments form a growing ecosystem that is unique in the industry.

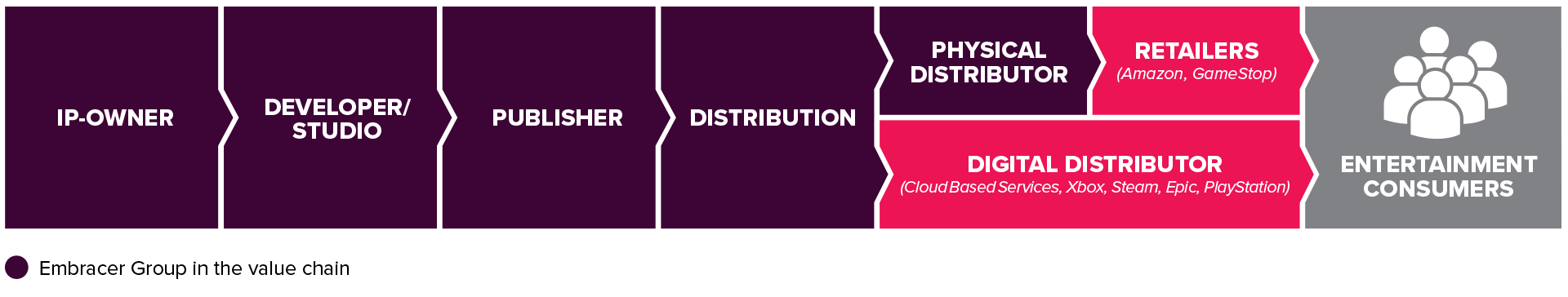

Embracer Group retains a strong position in all major value creating areas of the gaming market value chain.

The Group hosts an intellectual property portfolio consisting of more than 900 game titles, 103 internal development studios worldwide and a global capacity for online and physical retail publishing.

The Group has more than 100 ongoing game development projects in PC/Console Games, combining new IPs or revitalized franchises with existing franchises and active trademarks. Licensed IPs from Embracer Group are also an important source of organic growth. For Mobile Games, new content and campaigns, as well as investments in user acquisition activities, are particularly important for driving organic growth. For Tabletop, increased brand recognition and shelf space for existing franchises are key organic growth drivers.

Increased investments in user acquisition activities are justified when ad spend return requirements are met.

Embracer Group’s diversification and capabilities within the ecosystem coupled with its vast IP portfolio, consisting of over 900 IPs, including some of the most popular and iconic titles in gaming, comics, and other media gives a solid foundation for organic growth in the coming years.

At Embracer Group, building value through our IP is central. The Group strives to leverage its unique IP portfolio, structure, and development capacity as a basis for building a presence across key entertainment media formats.

The Group sees an opportunity to cross-fertilize IPs and strengthen licensing partnerships across gaming categories, different content formats, and platforms.

Partnerships and licensing agreements can improve predictability, lower business risk, and provide a positive impact on cash flow and profits. It also has the potential to enable further investments into making even greater games based on both established and new IPs, driving long-term organic growth.

Embracer Group aims to achieve predictable, long-term growth in earnings and free cash flow per share. A diversified portfolio across markets, segments, genres, and titles creates a more resilient earnings profile.

Embracer Group is run by entrepreneurs and owned by entrepreneurs. In order to align interests with founders, management, and key shareholders in acquired companies, Embracer Group has issued equity and uses long-term earnouts as part of considerations that are linked to specific operational and/or financial targets that the acquired company must achieve.

Embracer management and co-founders jointly own a considerable share of capital and votes in the Group. Most executives and people in leadership positions who do not own shares are incentivized by earnouts. Operative groups are responsible for incentivizing key employees and creating profit sharing at studio level, within the framework determined by Embracer Group to maximize and align long-term interests.

Any approved individual game development project presents a considerable business opportunity, but there is also an inherent risk element. Therefore, diversification and capital allocation really matter. There is limited dependency upon single titles. This enables our studios to be creatively bold in their mindset when developing games. Operative groups encourage individual game development studios to put quality first and create games that really stand out. The portfolio is diversified across more than 100 game projects across genres, targeting different audiences.

Our leverage target is to have Net Debt to Adjusted EBIT of 1.0x on a 12-month forward-looking basis. The Group may exceed this ratio for the right inorganic growth opportunity, but with the ambition to return to below 1.0x in the medium term. A strong balance sheet is emphasized, which reduces the financial risk and maximizes strategic flexibility.

Embracer Group is a global group of creative and entrepreneurial businesses in PC/console, mobile and tabletop games and other related media. The Group has an extensive catalog of over 900 owned or controlled franchises.

With its head office based in Karlstad, Sweden, Embracer Group has a global presence through its ten operative groups: THQ Nordic, PLAION, Coffee Stain, Amplifier Game Invest, DECA Games, Easybrain, Asmodee Group, Dark Horse Media, Freemode and Crystal Dynamics – Eidos. The Group has 103 internal game development studios and is engaging more than 10,000 employees in more than 40 countries.