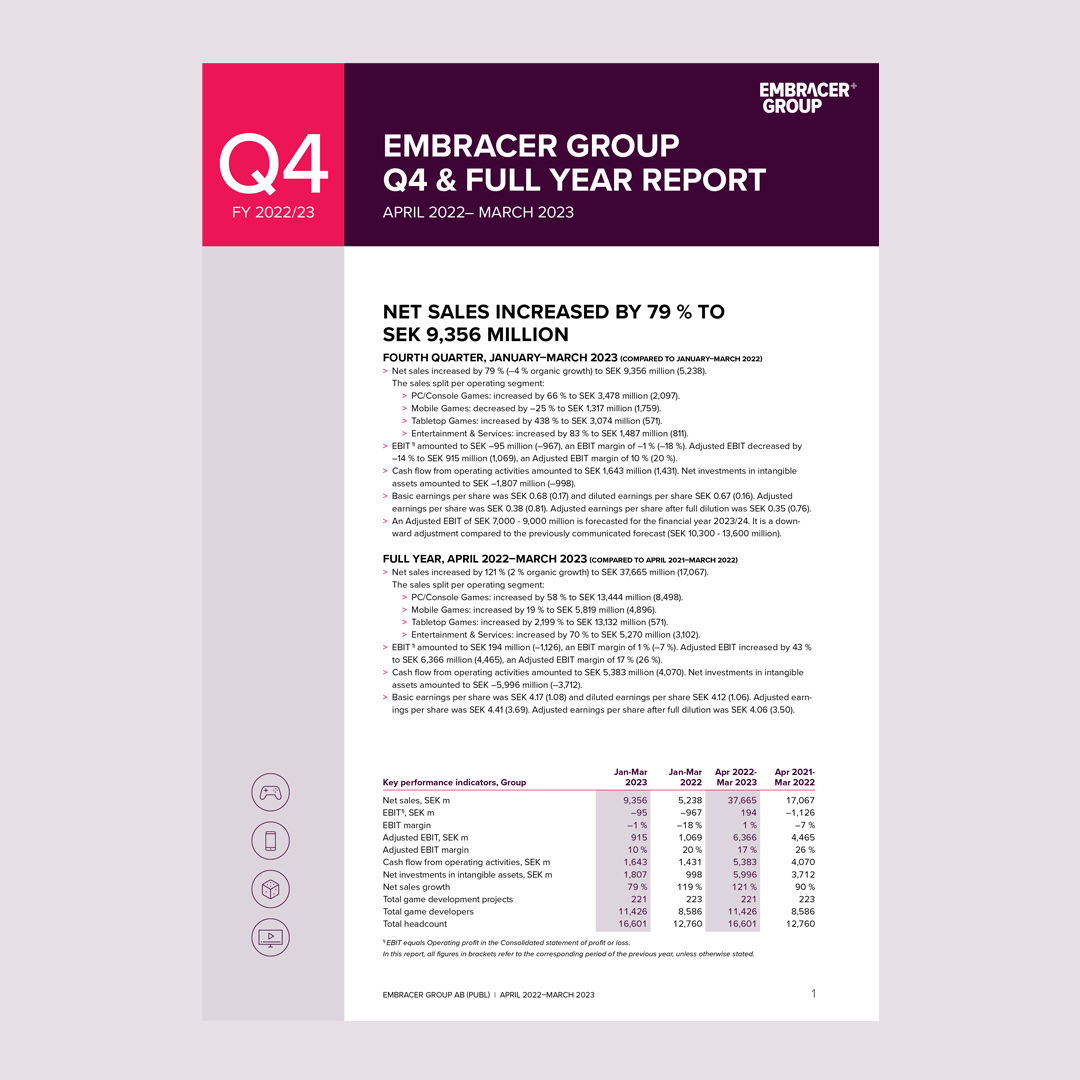

Embracer’s Net sales in Q4 grew by 79 % to SEK 9.4 billion. The organic growth in Q4 amounted to –4 %, with solid organic growth within PC/Console Games, Tabletop Games, and Entertainment & Services negated by tough comparisons and soft market conditions in the Mobile Games segment. In a seasonally quieter quarter across all segments and with limited new game releases in the PC/Console Games segment, we generated Adjusted EBIT of SEK 915 million and free cash flow of SEK –32 million. The Adjusted EBIT was also impacted by a few impairments related to ongoing canceled game development projects within Amplifier Game Invest and DECA Games, amounting to approximately SEK 100 million. A revaluation of earnout commitments resulted in a reduction of SEK 2.1 billion in cash earnouts and 14 million in number of shares expected to be issued.

For FY 2022/23, Net sales grew by 121 % YoY to SEK 37.7 billion, with organic growth of 2 %. We reached an Adjusted EBIT of SEK 6.4 billion. Compared to our guidance a year ago for FY 2022/23, we estimate that approximately 40 % of the shortfall in Adjusted EBIT is due to pipeline shifts, 30 % is due to weaker ROI in the PC/Console Games segment, and the balance is due to a softer gaming market and cost inflation factors.

Update on strategic partnership negotiations and FY 2023/24 forecast

We would like to describe some background and rationale for the aforementioned strategic partnership deal. Even if it serves little financial value going forward, it hopefully answers some questions about our communication and decisions.

In Q2 2022/23 we outlined our ambition to close a number of partnership and licensing deals that would be jointly transformative for Embracer. We have already entered into multiple partnerships and licensing agreements with industry partners on both AAA games and movies based on some of our iconic IPs. Except for the already announced deals that have more limited short-term financial value, we have been working on one groundbreaking strategic partnership agreement that would have set a new benchmark for the gaming industry.

Negotiations have been taking far longer than originally anticipated considering we had a verbal commitment already in October 2022. The specific deal included more than USD 2 billion in contracted development revenue over a period of six years. The deal would have enabled a catch-up payment at closing for already capitalized costs for a range of large-budget games, but also notably improved medium-to-long-term profit and cash flow predictability for the duration of the game development projects.

The transaction had many of the highest rated global advisories onboard with several hundred people engaged on both sides. All documentation was finalized and ready to go as of yesterday. We asked for the execution of the agreement before our Q4 announcement. However late last night we received a negative outcome from the counterparty. This decision was unexpected to the management and the Board of Directors of Embracer.

Capitalizing on our collective value through our partnership approach remains a key priority for the Group. We will continue to seek partnerships and collaborations with third parties across all our segments, including opportunities within transmedia. The demand for content has never been greater, and Embracer is well-positioned to meet that demand. We still have ongoing discussions about additional partnership and licensing deals, but the impact of potential deals is not included in the management forecast for the current financial year. That said, our ambition is still to increase the share of externally funded game development.

We have a solid pipeline of ongoing development projects, but multiple projects will need more time to live up to our high expectations of quality and to reach their full commercial potential. There have recently been several changes in expected release dates moving forward for unannounced titles in FY 2023/24. Consequently, several games with the potential to generate more than SEK 1 billion in net sales are now slated for FY 2024/25. Due to these delays and without the significant, transformative partnership deal, we expect to generate SEK 7 billion to SEK 9 billion (previously SEK 10.3 billion to SEK 13.6 billion) in Adjusted EBIT with improving cash conversion for FY 2023/24 and a healthy growth outlook in the following years.

In the PC/Console Games segment, we expect underlying earnings growth driven by more owned and self-published, large-budget game releases during the financial year. The forecast includes more cautious assumptions for certain releases and certain categories of games. In the Mobile Games segment, we expect a low single-digit organic growth, with gradually stronger growth during the financial year. We assume stable, soft underlying market trends with some gradual improvements to ad monetization throughout the year. The Adjusted EBIT margin is expected to be largely in line or slightly above FY 2022/23. In the Tabletop Games segment, we expect high-single-digit organic growth driven by the trading cards product area, with an Adjusted EBIT margin slightly below FY 2022/23.

Looking further ahead, in FY 2024/25 and FY 2025/26 we expect to deliver consecutively higher net sales, Adjusted EBIT and free cash flow, driven by a strong pipeline of highly anticipated games based on our iconic own and licensed IP. We are confident that we are nearing a notable inflection point in our business, and that we can utilize our scale and our significant collective value to the best effect. FY 2023/24 is not the year when we maximize the value in Embracer – but we will continue to take important steps and set the foundation for the years to come. We will hold a Capital Markets Day in the second half of the calendar year to give a detailed overview of both strategy and mid-term financial targets.

Soft performance in a seasonally quiet Q4

In the PC/Console Games segment, sales grew by 17 % organically in Q4 driven by several publishing deals accounted for as work-for-hire agreements as well as a continued strong back-catalog performance for Coffee Stain and a number of other strong franchises. However, delays have led to a limited number of large-budget game releases and a temporary under-absorption of fixed costs in FY 2022/23, impacting margins.

I am confident of notable organic growth, as well as profit and cash flow generation FY 2023/24.

Dambuster Studios and PLAION released Dead Island 2 on April 21, and it is encouraging to see the positive reception from both critics and players. Dead Island 2 sold 1 million units in its first weekend (21-23 April), exceeding management expectations. Measured over the first seven days of the sale period, it has become Deep Silver and PLAION’s biggest launch in history in both units and revenue. I am happy to state that the game has now reached a sell-out of well over 2 million units. It is rewarding to see that the decision to give the studio time to polish the game has paid off.

Several additional large-budget games are expected in FY 2023/24, including already-announced titles, such as Warhammer 40,000: Space Marine 2, Remnant 2 and Payday 3. There are still a number of unannounced notable titles awaiting to be announced for FY 2023/24.

In the Tabletop Games segment, Asmodee delivered a solid Q4 in a seasonally quiet quarter, with 6 % pro forma growth driven by strong performance in the UK and Central Europe. Trading cards continued to perform strongly, impacting the revenue mix and gross margin. Asmodee delivered a full-year Adjusted EBIT largely in line with our expectations from last year as well as a notably improved free cash flow in the second half of the year. In FY 2023/24, we expect a free cash flow conversion of above 100 % for Asmodee as the inventory levels fully normalize, with positive free cash flow also in the first half of the financial year.

The Mobile Games segment had a challenging Q4, with –36 % organic growth, but managed to deliver a solid Adjusted EBIT margin and free cash flow due to optimized user acquisition investments. Organic growth was impacted by very tough YoY comparisons, lower ad prices, and recent platform privacy changes. Excluding the effect of an ad mediation platform deal last year, organic growth was –24 % in Q4 while Adjusted EBIT grew by around 50 % YoY driven by lower user acquisition spending. There are positive signals with regard to ad monetization into FY 2023/24, with revenue behavior and advertising prices exceeding expectations toward the end of the quarter.

Strong foundation for the future

We have amazing publishers and studios across Embracer Group working on exciting development projects that will be driving profitable growth for many years ahead. Our operations within Mobile, Tabletop and Entertainment & Services provide a solid foundation with predictable, profitable and cash-generative businesses. Our roster of profitable PC/console franchises includes Borderlands, Deep Rock Galactic, Insurgency, Metro, Remnant, Satisfactory, Snowrunner, Tiny Tina’s Wonderland, Tomb Raider, Valheim, World War Z and many others, and the list grows longer on steady basis with the latest installment in the Dead Island franchise as a recent testament of the creative engine within our studio network.

The long-term ambition for Embracer is to build something significant and long-lasting, and to do it together with successful entrepreneurs and creators. Today, we have one of the industry’s largest portfolios of games and intellectual property, with more than 850 owned and controlled IPs, over 130 internal development studios and over 200 games in the pipeline, combined with transmedia expertise within tabletop games, comics and movies.

Working actively on efficiency improvement initiatives

We are working actively on efficiency improvement initiatives, which will be announced in due course. These efforts are likely to benefit profit margins and cash conversion for FY 2023/24 and reach full run-rate during FY 2024/25. We expect to reduce capitalized development projects, while continuing to invest to grow our established, profitable, and beloved franchises and IP’s. We will de-emphasize third-party publishing and externally developed games based on external IP’s.

We will increase focus on net cash flow and with further initiatives, we expect to reach a financial net debt below SEK 10 billion by the end of this financial year.

The special review that was announced by the Board of Directors in our Q2 report in November is still ongoing. The Board of Directors and the management team remain committed to maximizing long-term value creation for all businesses within Embracer. To conclude, I would like to send my thanks to all our shareholders, employees, customers, industry colleagues, and business partners for contributing to the continued prosperity and success of Embracer Group.

May 24, 2023, Karlstad, Värmland, Sweden

Lars Wingefors

Co-founder & Group CEO

Home

Home

It has been a challenging year, adversely impacted by game delays, weaker consumer demand and lackluster reception for certain notable releases. Late last night, we were informed that one major strategic partnership that has been negotiated for seven months will not materialize. We now expect to generate SEK 7 to 9 billion in Adjusted EBIT with improving cash conversion for FY 2023/24 and a healthy growth outlook in the following years.